Many of my would-be homes buyers assume that the typical down payment for a home is 20%. And they are not alone! According to survey data from the National Association of REALTORS®, thirty-five percent of consumers believe they need a down payment of 16% to 20% of the purchase price. Ten percent believe they need MORE than 20% for a down payment to purchase a home.

It’s important to know the real numbers when you are going to finance your home. 87% of home buyers finance their home purchase! That’s a lot. But if you are one of those buyers who is delaying your purchase, it may be due to persistent myths over down payment requirements.

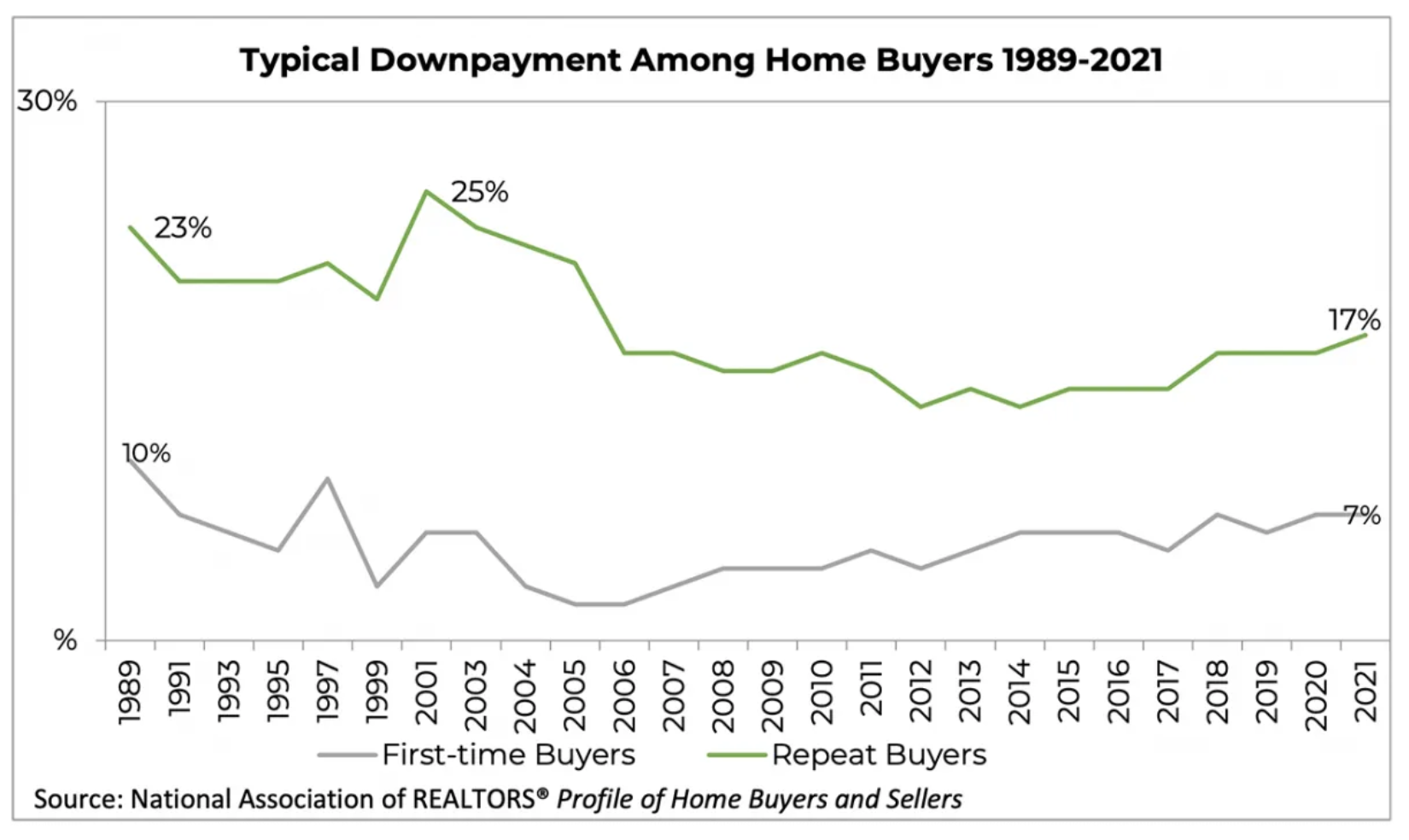

Look at this graph above (I will use this joke as much as possible). The typical down payment for a home is much lower than 20%. For first-time home buyers, the average down payment over the last three years has ranged between 6% and 7%!

Repeat Buyers Put More Toward Their Down Payment

According to NAR, for repeat buyers, the typical down payment was 17% last year. So why is the down payment higher than for first time buyers? Home equity for owners has grown. People on their second or third or more purchase roll the equity from the previous home into buying their next home. But for the first time buyers, equity is not a high priority especially compared to gaining entrance into the market.

First Time Buyers Are Using The FHA Loan

Buyers have several loan options that don't even require putting 10% down, let alone 20%. About 23% of first-time buyers represented in the survey chose a Federal Housing Administration loan. FHA loans allow borrowers to put down as little as 3.5% on the purchase of a home. That significantly lowered the overall down payment average.